Monthly report · No.21

MONDAY, DECEMBER 22, 2025

The Home Factor Forecasts Brighter Days Ahead For 2026

By Declan Spring

TIS the season! This past year life at The Home Factor has been a reflection of our core belief that quality always triumphs over quantity. We are intentionally choosing not to scale into a too-big, transactional agency, focusing instead on deep, personalized service that aligns with our relationship-first living. Declan continues to find immense joy building community within the professional world through his ongoing podcast, The Mostly Real Estate Podcast. Since getting her Feng-Shui certification, Denitsa has been hugely enjoying helping not only listing clients but homeowners with consultations, bringing new life to many old spaces. We are thrilled to share that our tight-knit circle is already growing: We look forward to officially welcoming Ehsan’s wife, Kat, as a team member next year.

We work exclusively by referral because it is rooted in the simple philosophy we strive to live by: Be the change you want to see in the world. For us, that means creating a business built on integrity, genuine relationships, and focusing our energy entirely on serving you, our valued clients and friends, at the highest level. When you introduce us to a family member, colleague, or friend, you are giving us the most meaningful form of endorsement and the ultimate gift of partnership. It allows The Home Factor to bypass the cycle of impersonal marketing and concentrate on delivering exceptional, thoughtful results. We believe the highest service is found not in seeking, but in being and providing our whole attention to the task at hand. Thank you for making our success possible, one trusted, thoughtful relationship at a time.

With immense gratitude and wishing you a holiday season filled with peace.

the state of the market

The Housing Factor

By Ehsan Habib

*Data is sourced from the MLS and considers detached Single-Family Homes

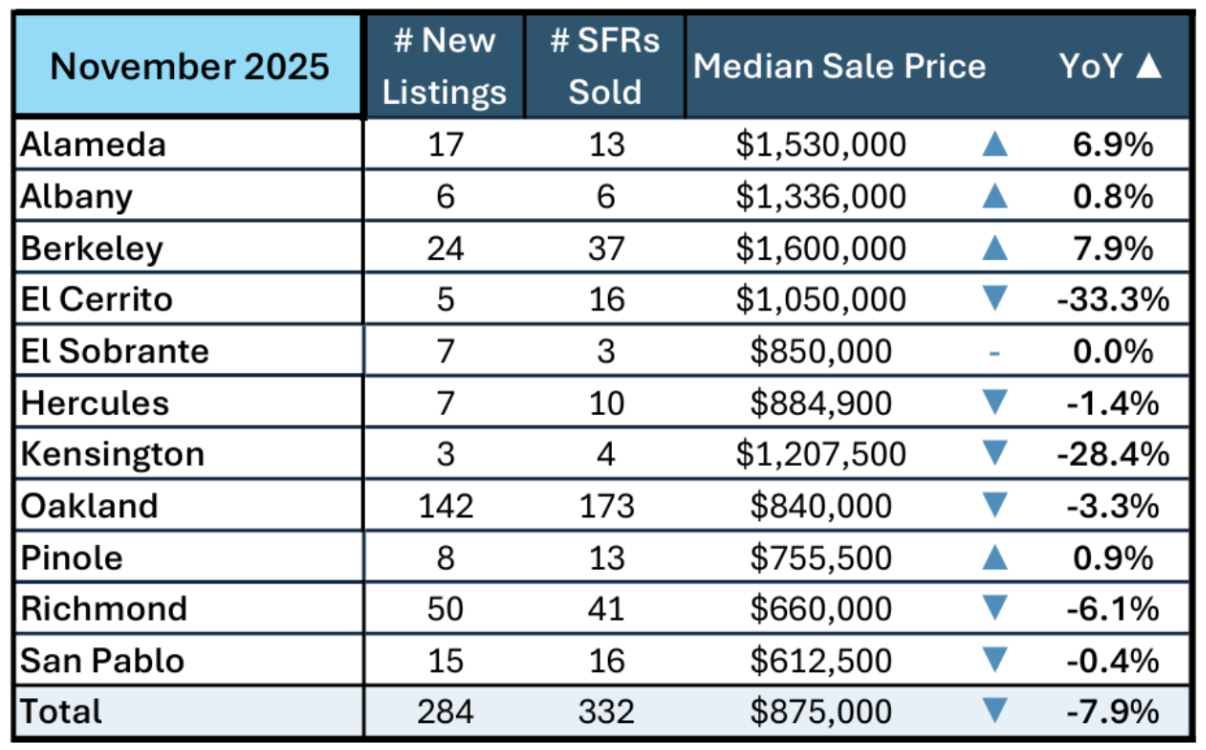

The market during November and December has continued the correction trend that’s been a common feature of the year. The absorption rate (how quickly listings are sold) is a little stronger than this time last year, and the Months’ Supply of Inventory has reduced by half a month between October and November. We end the year with much lower inventory in our 3 biggest cities vs same time last year. We’re ending the year for the combined number of active single-family homes in all of Oakland, Berkeley, and Richmond in 2025 at 370 units vs 427 in 2024. Despite a higher number of units mid-year, the past 6 months have seen lower numbers of available units. Most realtors have felt the contraction.

The overall supply of inventory dropped by 21% between October and November (about 100 homes collectively for the cities we track). This is about the same movement that we’ve seen for the past 3 years, and coupled with yet another decrease in Year-over-Year (YoY) prices, signals that Sellers are adjusting to Buyer demand. Sellers with stagnant listings over the second half of 2025 have increasingly settled for sale prices that were below their initial expectations. Sellers who do not receive satisfactory offers will often pull their listing from the market to either relist again in the future, or rent out the home. Despite the stringent regulations in California and many Bay Area cities, real estate remains a solid investment, and the rental market remains a viable option for most would-be sellers.

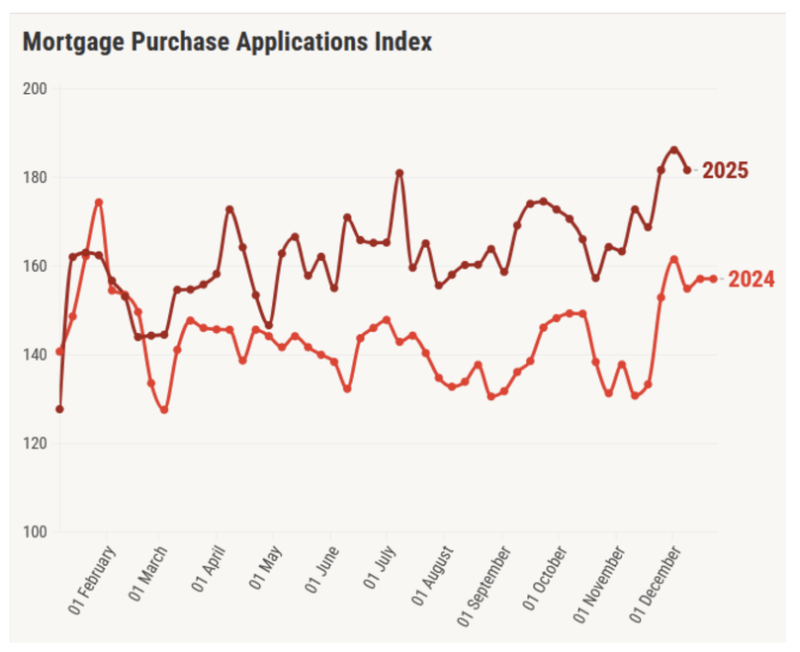

For people looking to list their homes in 2026 - the outlook remains strong. Largely due to a weak labor market and low energy costs, many are predicting interest rates to continue to fall. Fannie Mae forecast in a press release on September 23 that mortgage rates on 30-year fixed-rate mortgages would end at 6.4% in 2025 and at 5.9% in 2026. This is generally in line with a forecast by the Mortgage Bankers Association in late October that rates in 2026 would remain between 6% to 6.5%. For a deeper dive into the 2025 mortgage roller coaster and risks that remain relevant 🎧 please click here for an April 2025 podcast with mortgage expert Dominic Villa of Castle Hill Mortgage.

This expectation, coupled with increased buyer demand in 2025 vs 2024, is some of the best evidence we have that 2026 will be a better year than 2025. For buyers and sellers alike, if you have any intention of making a move in 2026, we strongly recommend calling us now to begin strategizing and preparing. This is especially important for cash-heavy buyers.

Click here for our earnest advice to anyone waiting for a crash or for housing to become “more affordable”.

And of course, for data specific to your city or neighborhood, or any insights and strategies specific to your situation, please reach out to either myself or Declan directly. We both regularly log data directly from the MLS, and we don’t know anyone else who takes the time to study the market so thoroughly.

Mortgage news

MORTGAGE MUSINGS

By Evelyn Freitas | VP of Mortgage Lending at Guaranteed Rate NMLS 247578

How It Started. How It’s Going. A 2025 Mortgage Year-in-Review

Happy Holidays! December is a natural time to reflect, and this month we’re taking a “how it started, how it’s going” look at mortgages. This brief year-in-review focuses on what changed in financing over the past year—from interest rates to loan options—and what those shifts mean for buyers and sellers throughout the Bay Area.

At the beginning of the year, mortgage rates opened higher than many buyers expected, generally landing in the low-to-mid 7% range. That led many people to pause and wait for conditions to improve. As the year unfolded, rates moved lower and stabilized, spending time in the low- to mid-6% range depending on loan type and market conditions. While that shift helped affordability, the bigger story was how financing conversations evolved.

Rather than focusing on interest rates alone, 2025 became a year of strategy and negotiations in financing. Seller credits played a larger role in many transactions, often used to offset closing costs or fund temporary rate buydowns such as 2-1 or 1-0 programs. These tools allowed buyers to manage early payments while keeping long-term ownership goals in focus.

Loan choice also mattered. Across the Bay Area, 30-year fixed-rate conventional loans remained the most common option, offering stability in an uncertain environment. FHA loans continued to support first-time buyers with lower down-payment options, while VA loans remained one of the strongest benefits available to eligible veterans and service members. VA financing stands out with competitive terms, no monthly mortgage insurance, and in my practice, lender fees waived entirely for VA borrowers.

Adjustable-rate mortgages (ARMs) also regained attention this year. Five-, seven-, and ten-year ARMs offered lower initial rates for buyers planning a future move, refinance, or income change. Used thoughtfully, they became a planning tool rather than a risk-based decision.

Finally, non-QM programs continued to fill an important gap in 2025. Designed for self-employed borrowers, business owners, and buyers with variable income, these loans use alternative documentation such as bank statements or assets to support qualification when traditional guidelines fall short.

Looking ahead to 2026, increased loan limits and continued flexibility across mortgage programs create new opportunities. If a purchase or refinance is in the cards for 2026 — or if you simply have mortgage questions you’d like to ask — a conversation can help turn questions into answers and bring clarity well before a decision is needed. I’m always available for a chat at Evelyn.Freitas@rate.com. Enjoy the holidays, and have a Happy New Year!

Create Harmony In Your Home

By Denitsa Shopova

Why Feng Shui Coupled With My Personalized, Custom Home Styling is Your Secret Real Estate Advantage

Whether you are preparing to list your home or you’ve just received the keys to a new one, the "vibe" of a space isn't just an abstract feeling. It’s the result of how energy, or Qi, flows through your environment. That is why I am proud to offer Feng Shui Consultations as well as simple Custom Home Styling Consultations as a core part of my real estate services.

The Benefits of an Aligned Home

Feng Shui is the ancient art of arranging your living space to create balance with the natural world. When your home is aligned, the benefits ripple into every area of your life.

Reduced Stress: Simple shifts in furniture placement can transform a chaotic room into a sanctuary of calm.

Enhanced Prosperity: By activating specific areas of your home (the "Wealth Corner"), you invite abundance and career growth.

Better Sleep & Health: Optimizing the bedroom layout can improve rest and physical vitality.

Faster Sales: For sellers, a home with good flow feels "right" to buyers the moment they walk in, often leading to quicker and higher offers.

Why "Gift" Yourself a Consultation This Season?

We often spend thousands on renovations and decor, but we rarely invest in the energy of the home or a simple decluttering of space and rebalance of objects already present. Gifting yourself a Feng Shui consultation is an act of self-care. It’s about ensuring that your most significant financial investment, your home, is also your most significant emotional support system.

"A house is made of walls and beams; a home is built with love and dreams. Feng Shui ensures those dreams have the room to grow."

Ready to bring more balance to your space? I’m currently offering a New Year Harmony Session for my clients. Reach out to me today at denitsa@thehomefactor.com to book a no obligation discovery call! Wishing you a New Year that’s in balance.

SUBSTACK: WHY our monthly newsletter isn’t enough

By Declan Spring

Think you’re “in the know” from our monthly recap? Think again. Real estate markets move fast, and a once-a-month snapshot can’t keep up.

That’s where our Weekly Substack comes in — it’s your early-warning system, unpacking fresh inventory data, interest-rate shifts, neighborhood trends, and hidden opportunities well before the headlines catch up.

Every issue delivers:

Local open-house & listing insights

Real-time rate analysis

Tactical tips for buyers, sellers, and refinancers

Market signals you won’t see anywhere else

Make your decisions with confidence — not hindsight.

👉 Click here to subscribe to our weekly Substack now and stay one step ahead.

THE HOME FACTOR ON YOUTUBE!

Our YouTube channel offers short, real-world videos showing how we transform and market the older homes we represent. Subscribe—and feel free to share it with anyone considering a sale who wants to see how we guide older homes into newer hands.

👉 Click here to subscribe to our YouTube Channel for some behind the scenes magic..

We are The Home Factor, REALTORS®, serving clients in the San Francisco Bay Area, and beyond.

Declan Spring · Declan@thehomefactor.com

(415) 446-8591 · DRE#01398898

Denitsa Shopova · Denitsa@thehomefactor.com

(510) 220-1634 · DRE#02137852

Ehsan Habib · Ehsan@thehomefactor.com

(510) 730-4516 · DRE#02166899

GUIDING AND INSPIRING PEOPLE TO INCREASE THEIR FINANCIAL STABILITY AND LOVE OF LIFE THROUGH WELL DESIGNED HOME OWNERSHIP

The Home Factor • DRE#01398898 • Powered by Keller Willams • 2089 Rose St, Berkeley, CA 94709 • Declan@TheHomeFactor.com · (415) 446-8591